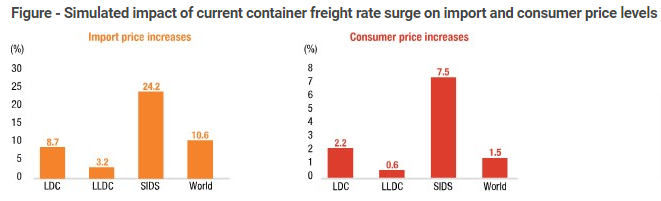

In its Review of Maritime Transport for 2021, United Nations Conference on Trade and Development (UNCTAD) said that the current surge in container freight rates, if sustained, could increase global import price levels by 11% and consumer price levels by 1.5% between now and 2023.

The impact of the high freight charges will be greater in small island developing states (SIDS), which could see import prices increase by 24% and consumer prices by 7.5%. In least developed countries (LDCs), consumer price levels could increase by 2.2%.

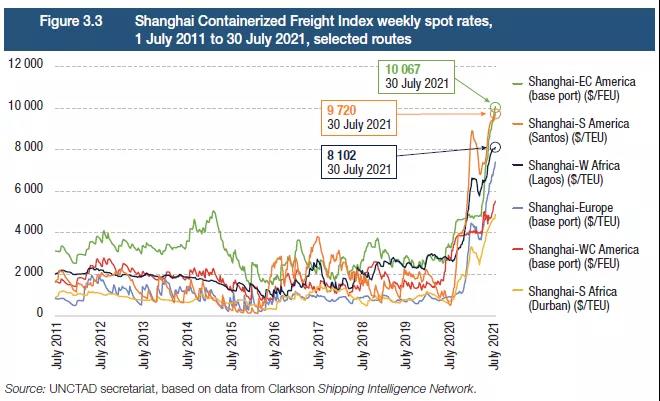

By the end of 2020, freight rates had surged to unexpected levels. This was reflected in the Shanghai Containerized Freight Index (SCFI) spot rate.

For example, SCFI spot rate on the Shanghai-Europe route was less than $1,000 per TEU in June 2020, jumped to about $4,000 per TEU by the end of 2020, and rose to $7,552 per TEU by the end of November 2021.

Furthermore, freight rates are expected to remain high due to continued strong demand combined with supply uncertainty and concerns about the efficiency of transport and ports.

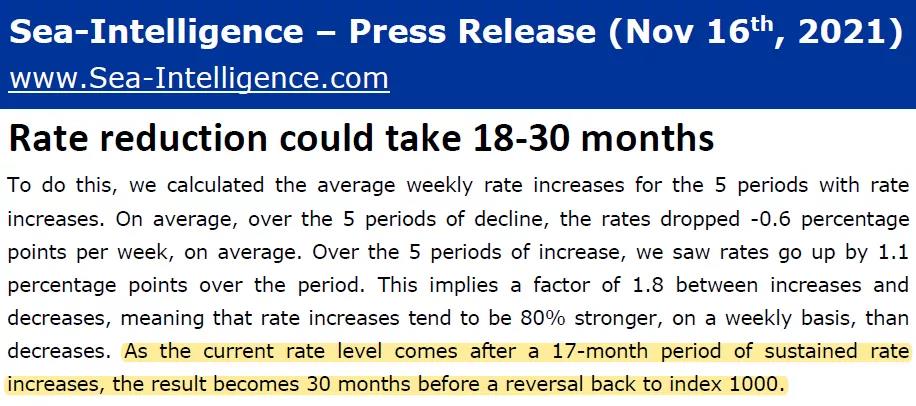

According to the latest report from Sea-Intelligence, a Copenhagen-based maritime data and advisory company, ocean freight may take more than two years to return to normal levels.

To do this, we calculated the average weekly rate increases for the 5 periods with rate increases. On average, over the 5 periods of decline, the rates dropped -0.6 percentage points per week, on average. Over the 5 periods of increase, we saw rates go up by 1.1 percentage points over the period. This implies a factor of 1.8 between increases and decreases, meaning that rate increases tend to be 80% stronger, on a weekly basis, than decreases. As the current rate level comes after a 17-month period of sustained rate increases, the result becomes 30 months before a reversal back to index 1000.

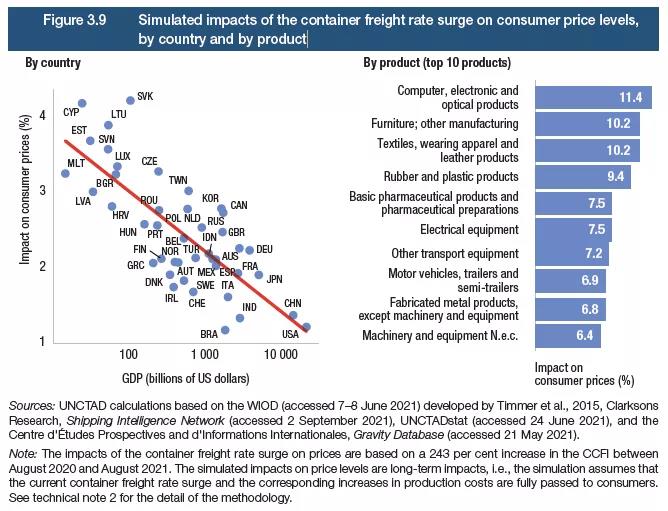

UNCTAD's analysis shows that higher freight rates have a greater impact on the consumer prices of some goods than others, notably those which are more highly integrated into global supply chains, such as computers, and electronic and optical products.

The high rates will also impact on low-value-added items such as furniture, textiles, clothing and leather products, whose production is often fragmented across low-wage economies well away from major consumer markets. The UNCTAD predicts consumer price increases of 10.2% on these.

Post time: Nov-30-2021